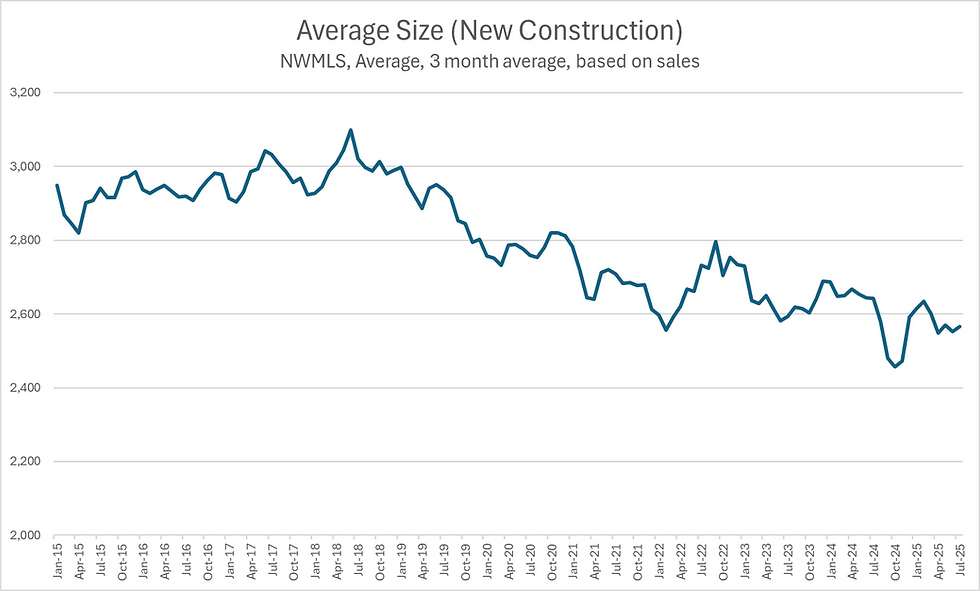

Are Builders Responding to Higher Interest Rates by Building Smaller Homes?

- Braden Gustafson

- Aug 5, 2025

- 1 min read

Pacific Northwest new home sales data shows a clear pattern. New homes are getting smaller. This seems like an obvious response to the lack of affordability due to interest rate jumps in 2022, but it has been on a decline since 2018. That is when the affordability started to become an issue due to a combination of increasing prices and interest rates.

The chart shows the average square footage of new construction has dropped from around 3,000 square feet in 2016–2017 to roughly 2,600 square feet today.

The most common new homes are between 1,500 and 2,500 square feet, but there’s been a noticeable uptick in smaller homes since mortgage rates began climbing in the first iteration in 2018. In the years before 2018, homes under 1,500 square feet typically made up less than 10 percent of new sales. That has increased to 20% now.

The share of new homes 2,500 to 3,500 square feet has gone from 40% share to less than 30%.

In the end, builders are driven by margins and if buyers are showing more demand for smaller homes due to affordability, the builders will keep building them.

Comments