The Interest Rate Drops: A Small Step Toward Affordability

- Braden Gustafson

- Sep 13, 2024

- 1 min read

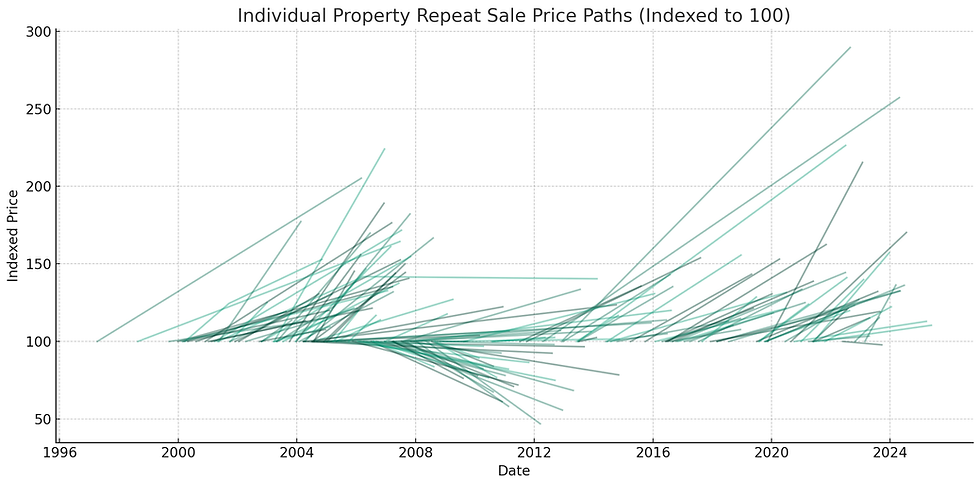

Recent drops in mortgage interest rates have made homeownership slightly more affordable than in recent months. Today's reading is 6.14% according to Mortgage News Daily, but I have heard quotes at 5.90%. But the reality is that homes remain far out of reach for many compared to historical trends. As shown in the graph below, while rates are helping to ease monthly payments, the overall affordability of housing has not returned to what we’ve seen in past decades. The median home price in Whatcom County is $619,000, but a typical household can only afford $366,000.

The root of the issue is supply. Many current homeowners locked in extremely low mortgage rates over the last few years, and it simply isn’t a smart financial move for them to sell and take on a higher-rate mortgage for their next home. This has created a situation where fewer homes are coming onto the market, keeping prices elevated (and even increasing) and keeping housing unaffordable despite slightly lower rates.

It's important to note that this isn’t a statement on whether it’s a good time to buy a home or not—that's a highly personal decision. What we can see is that affordability challenges are likely to persist in the near term unless there is a significant increase in housing supply. At some point, affordability will improve, which means one of three things: Home prices decreased, median income increased, and/or interest rates decreased.

Looking at the graph below, true affordability is 100.0, but there are few times historically where Whatcom County has hit that number.

Comments